How would you feel about your monthly water bill increasing 44.47 percent by 2027?

How would you feel about your monthly water bill increasing 44.47 percent by 2027?

Remember, consumer prices have already increased 21.5 percent over the last four years, per the government’s fabricated data. So, would an additional 44.47 percent increase in your water bill by 2027 warm your soul?

This is the rate increase being proposed by California’s Golden State Water Company for residents within the Santa Maria Service District. If approved, as stated in the public participation hearing notification that was sent to customers, the average residential user would see their monthly bill spike from $67.94 in 2024 to $101.81 in 2027, excluding surcharges.

Other service districts supplied by Golden State Water Company are facing similar increases. These rate increases are being requested to fulfill the company’s General Rate Case (GRC) that was filed last year with the California Public Utilities Commission. The GRC proposes local infrastructure investments and water rates for the years 2025, 2026 and 2027.

California residents, like residents of many states, are being subjected to a relentless barrage of utility bill increases. One recent proposal for California electricity rates included a communist scheme of charging customers based on their income, not by how much power they use. Under this proposal, people with higher incomes would pay more for electricity than people with lower incomes, regardless of how much power they use.

This income based rate structure proposal was ultimately replaced with a new, two-part billing structure. The first part includes the customer usage rate. The second part includes a flat rate – in addition to the usage rate – of $24.15 for most customers. Certain breaks for low-income users were included.

Do You Prefer a Recession?

Both the latest PCE price index and CPI report may be less bad than they were a few years ago. Regardless, prices are still increasing at a rate that’s well above the Federal Reserve’s arbitrary 2 percent target. Add escalating utility bills to the mix, and American households are getting squeezed hard.

One solution to inflation is a recession. An economic downturn where people lose their jobs and are forced to tighten their belts would reduce demand for goods and services. This could slow the rate of consumer price inflation. It may even lead to deflation.

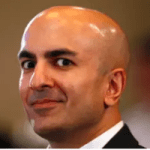

This unpleasant solution to inflation was recently advocated by Hank Paulson’s former TARP bailout boy, wood chopper extraordinaire, and current Minneapolis Fed president, Neel Kashkari. In fact, while speaking on the Financial Times podcast, The Economics Show, Kashkari said Americans prefer it:

“Americans’ ‘visceral’ hatred of inflation meant that some people would prefer a recession to a jump in prices.

“The economy is, in the US, quite strong, the labour market is strong, inflation is coming down and many, many people are deeply unhappy about the status of the economy. I think it’s because of the high inflation that they’ve experienced.”

Kashkari shared these insights as rationale for holding the federal funds rate at its current 23-year high range of 5.25 to 5.5 percent. According to Kashkari, more data is needed to convince the Fed’s interest rate fixers that inflation is receding. And that it is better to leave rates higher for longer and risk lower growth than have consumer price inflation spiral further out of control.

Are You Ready for Stagflation?

Perhaps Kashkari is angling for Fed Chair Jerome Powell’s job when the term ends in 2026. His crazy eyes and even crazier ideas on credit market intervention make him particularly suited for the job. Who knows?

But clearly Kashkari is overestimating what the Fed can and cannot control. Higher interest rates make borrowing costs more expensive. Presumably this slows economic growth, as businesses and individuals have less motivation to borrow and spend.

As Kashkari sees it, this could tip the economy into a recession and stomp out consumer price inflation. Yet it may not be an either-or question. Things are rarely as cut and dried as a central planner believes.

For example, what if the economy slows yet consumer prices still rise? What if stagflation rears its ugly head for the first time since the late 1970s?

Maintaining relatively high interest rates can only do so much. We say relatively high because, while interest rates are dramatically higher than they were a few years ago, they are actually slightly below their long term mean. So maybe the Fed should be considering further rate hikes rather than rate cuts.

The other critical factor driving consumer price inflation is deficit spending. Even with Washington’s April income tax boon of $482 billion, the Treasury is on target to run close to a $2 trillion dollar deficit in fiscal year 2024. Deficits of this order are extremely inflationary. They also put the long-term finances of the U.S. government and the dollar in peril.

Cutting interest rates at this point would likely push consumer prices higher. But holding rates where they are, in the face of $2 trillion deficits, won’t necessarily slow inflation.

This Recession Won’t Stop It

In effect, monetary policy is stepping on the brake while fiscal policy is stepping on the gas. And this is why things could be setting up for an inflationary recession – stagflation – for the U.S. economy in the very near future. It may already be happening.

Recent feedback from Chicago-based purchasing managers signals an economy that is significantly contracting. The Chicago PMI for May came in at a ghastly 35.4. A value below 50 indicates that manufacturing activity is contracting.

This marked the sixth consecutive reading in contraction territory. In addition, it is the lowest level since May 2020, at the depths of coronavirus panic lockdowns. To find another reading this low you must go back to the financial crisis of late 2008.

When you dig into the report nearly all of the various components are falling. New orders, employment, inventories, supply deliveries, production, order backlogs. All are falling and signaling contraction.

However, there is one component that’s rising. That is, prices paid.

Thus, manufacturing is contracting while prices paid are rising. This looks and feels a lot like stagflation to us. Moreover, it provides early evidence that, with all the deficit spending taking place, and contrary to Kashkari’s belief, a recession cannot be counted on to slow consumer price inflation.

Not until Washington gets serious about balancing the budget will consumer price inflation recede. Recession or no recession. With all the deficit spending, it really doesn’t matter.

And the earliest Washington could get serious about reducing the deficit is well after the election. By then, the misery of stagflation will be well upon us.

Losing your job is bad enough. But simultaneously having your water bill spike 44.47 percent is an exceptional insult.

Good luck! You’ll certainly need it.

[Editor’s note: Does paying your electricity bill got you down? Don’t sweat it. I’ve got you covered. In fact, I recently prepared a unique publication titled: “Energy Independence: Backyard Energy Savings and Abundant Power In A World Without Reliable Electricity.” >> Click Here, to access a complimentary copy.]

Sincerely,

MN Gordon

for Economic Prism

Avoidance like mutant spike proteins