By Louis Basenese, Wall Street Daily

It doesn’t matter what political party you pledge your allegiance to.

If you’re a dividend investor – heck, if you’re an investor of any sort – you need to adamantly oppose President Obama’s proposed 2013 budget.

Again, this isn’t about politics. It’s about investing. Read on to find out why… and then, speak up!

Higher Taxes and Lower Yields, Here We Come!

Earlier this week [last week], President Obama unveiled his proposed budget for the 2013 fiscal year. It includes roughly $2 trillion in new taxes and fees. And the bulls-eye is squarely positioned on investors, particularly dividend investors.

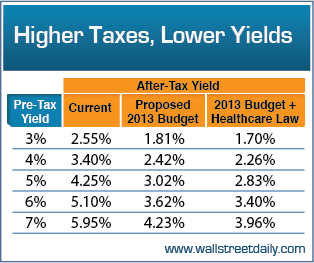

Specifically, the budget calls for increasing the top tax rate on qualified dividends to 39.6 percent, up from 15 percent. If we factor in the surcharge included in the healthcare reform package, the top dividend tax rate jumps to 43.4 percent.

At face value, you already know that the impact on after-tax yields would be significant. But let me show how much of a pay cut we’re talking about.

And as I’ll explain, the timing for these proposed hikes couldn’t be more terrible…

Kiss Corporate Generosity Goodbye

As you’re well aware, conventional and safe saving mechanisms, like money market funds, CDs and U.S. Treasuries, offer paltry yields. Which has everybody hunting for a little more meat. And that’s putting high-quality dividend stocks in high demand.

Thankfully, corporations are responding positively to the increased attention. Companies are actively upping their payouts to shareholders. The dividend payout ratio for the S&P 500 Index is up 32 percent since August 2009. And this year analysts expect the total dollar amount of dividends to reach a record high of $263 billion.

However, the proposed budget promises to stop this trend of increasing payouts dead in its tracks.

It’s ironic, but true. The government’s effort to get its hands on more dividend income is actually going to lead to less dividend income. Why? Because if the budget passes, the dividend tax rate will exceed the capital gains tax rate. By almost 20 percentage points (43.4 percent vs. 23.8 percent).

Under such circumstances, companies would be fools to pay out their profits via dividends. They’d be giving away their profits to the government. Instead, they’ll reinvest the money in the business to try to increase share prices. That way, both the company (via higher profits) and shareholders would benefit (via lower taxes rates).

Or, as Gina Martin Adams, an institutional equities strategist for Wells Fargo, says, if the taxation of dividends is raised above the capital gains tax rate, “the dividend theme could die on the vine.”

Amen, sister! And the last thing any investor wants is for companies to shutter their dividends payments.

Here’s Why Every American Should Care

It’s true that the proposed tax increases only apply to families earning over $250,000 per year or individuals earning over $200,000 per year. Since the majority of Americans don’t earn that much money, they’re probably thinking they won’t be impacted.

Wrong!

The law of unintended consequences ensures all Americans are going to suffer from the higher dividend tax rates.

As I said before, the higher dividend tax rates are going to force companies to cut back on their dividend increases. And that means all dividend investors are going to be putting less income into their pockets.

Remember, dividend income accounts for roughly 90 percent of total stock market returns over the long term. So the President’s proposed budget actually threatens the long-term prosperity of all investors.

Not to mention, taxing the “rich” more on dividends is merely a sales pitch.

Right now the White House Press Secretary, Jay Carney, is saying that the proposed tax increases amount to “asking those who have done exceptionally well over the last 10 years, the wealthiest Americans, pay a little bit extra… pay their fair share.”

Nonsense! Taxing the rich first is simply the path of least resistance. So take heed: If these tax increases go through it will be much easier to push them through on all Americans in the not so distant future.

Bottom line: This isn’t about class warfare or politics. The President’s proposed budget threatens to cut into all investors’ returns. So exercise your right in our wonderful democracy to speak up! Before it’s too late.

Sincerely,

Louis Basenese

for Economic Prism

[Editor’s Note: Louis Basenese is Co-Founder and Chief Investment Strategist for Wall Street Daily. In addition to being an expert on technology and small-cap stocks, Louis is also well versed in special situations, including Mergers & Acquisitions and spinoffs.]

Return from Obama’s Budget is Every Investor’s Worst Nightmare to Economic Prism